This article was originally written for and published in the Globe and Mail - Report on Small Business, on May 20, 2014.

It’s safe to say that every startup or growing small business (“SMB”, collectively) has some form of business plan. The plan may be formal, considered, and written down, or it may simply be floating inside the head of the business owner or Founder. It may be comprehensive, basic or somewhere in between. Through all of this a bunch of smart questions get asked and, hopefully, a bunch of smart answers obtained. Forecasts, budgets are created and hiring decisions made taking into consideration the answers to the questions.

The Finance Gap

After all this careful preparation for growth and success, time and time again we see that SMB growth plans mess up big-time in one very important area: that of financial stewardship and expertise.

Too often, no real, formal results-monitoring systems are put in place to measure results against expectations. Reports actually showing results are rarely prepared, and when they are, may or may not be validated against performance criteria. It's a sadly common occurrence that the business’ founder is not even aware what it is that he or she should be measuring to determine how successfully (or more frequently, unsuccessfully) they are realizing the goals of their plan.

Operating in this void, an SMB's chances of success decrease dramatically. The business is not adequately addressing its financial risk when it’s at its highest level.

Surprisingly, this isn't because the Founder doesn't know about or believe that this risk exists. It's because he or she doesn't think that the business is big enough yet to afford to manage it. Their plan contemplates hiring a business finance expert–a CFO–when it can be afforded on a full-time basis. They much more often than not never get that chance, due to one big dangerous hole in the front of the plan: the Finance Gap.

Why the Finance Gap Exists

Why would such an important piece of the plan be so frequently mismanaged? In part because financial expertise has been, historically, both expensive and hard to find. The level of technical training and experience required to effectively manage an SMB's finance risk is high. It’s not an easy thing to do, and it’s expensive as a result.

In addition, a significant number of financial professionals use the SMB market as a stepping stone, using this experience as a training ground before moving on to a larger enterprise, which makes even expensive expertise hard to find. In the past, those financial professionals who did want to remain in the SMB market gravitated to public accounting firms, where dealing with the demands of year-ends and tax compliance are full-time endeavours themselves.

Up until only very recently, the work of this specialty required not only technical skills but significant man-hours expended to simply gather the information required to oversee the risk. As the data resided locally, it also required physical attendance at the SMB's place of business. While the idea of sharing CFO expertise between SMBs has been explored, it wasn’t a financially feasible venture.

Simply said and for good reasons, CFOs for SMBs have historically been few and far between and when available, costly. SMBs with financial expertise needs and growth aspirations truly couldn't afford the skills. Founders were left with gaps in their plans, hoping they could manage until they could afford someone full-time… almost always with negative results.

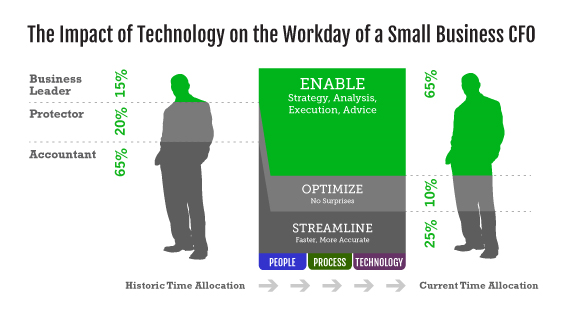

Technology Has Fixed This

Thankfully, there is hope. Recent advancements in technology, namely cloud computing (and the development of cloud-based applications that automate a significant amount of technically complex, historically manual tasks) enable such financial professionals to share their skills among multiple clients much more efficiently, allowing these skills to be accessed affordably when and where they are most needed. This isn’t a small change - it’s a transformative one. By de-tethering the CFO from the business location, for example, applications such as Xero, Receipt-Bank, Salesforce and Unleashed (to name a few) allow financial risk experts to split time between multiple SMBs in a way that was previously impossible. An SMB CFO’s workload has changed abruptly. It was once heavily weighted toward data collection, recording and reporting. Now, because of the evolution of technology that can do this automatically, time is freed up to be shared among clients, reducing those clients’ costs by up to 50%.

Thankfully, there is hope. Recent advancements in technology, namely cloud computing (and the development of cloud-based applications that automate a significant amount of technically complex, historically manual tasks) enable such financial professionals to share their skills among multiple clients much more efficiently, allowing these skills to be accessed affordably when and where they are most needed. This isn’t a small change - it’s a transformative one. By de-tethering the CFO from the business location, for example, applications such as Xero, Receipt-Bank, Salesforce and Unleashed (to name a few) allow financial risk experts to split time between multiple SMBs in a way that was previously impossible. An SMB CFO’s workload has changed abruptly. It was once heavily weighted toward data collection, recording and reporting. Now, because of the evolution of technology that can do this automatically, time is freed up to be shared among clients, reducing those clients’ costs by up to 50%.

What Skills Should a Part-Time SMB CFO Possess?

Not every financial professional is cut out to be a CFO for SMBs. It's important that they are:

SMB Founders themselves

The world of startup and small business is unique. The CFO needs to live in this world to understand the specificities of SMB financial risk.

Experts in operational finance with experience in compliance

A common issue raised by Founders when asked about their year-end accountant's service is the lack of proactive business advice. The reason for this is two-fold: they are too occupied dealing with the constantly changing rules, and frankly lack the technical training or experience to identify or deal with operational finance risk. An SMB CFO focuses on this including knowing what needs to be done to be compliant.

Tech-savvy

Technology now plays a very large role in a CFO's world. To be efficient and to have the data to manage the financial risk of an SMB requires an in-depth understanding of the tools available that enable this.

The Finance Gap Can Now be Bridged

The result is that the Finance Gap can and now must be bridged. SMB's should now include the skills required to manage the financial risk in their plan much sooner and at a significantly reduced cost, then seek out the professionals that possess the qualities outlined above. The results will be amazing.