When it comes to deducting fun and leisure, for most Canadians small business owners the rules can be confusing and quite often taxing.

As CFO’s for small business in Canada, we are frequently asked questions about the income tax treatment of business development, entertainment, restaurant bills, club memberships, green fees, etc, all which fall under a general category we would call leisure and recreational activities.

There are specific rules for each such activity.

As these rules and related terminology can be hard to remember, firstly, we think an overview is very helpful.

The Business Test

The first rule that applies to any such expenditure: They must be incurred to earn property or business income. Both these terms are defined in the Canadian Income Tax Act (ITA). This we’ll call the “Business Test”.

The Evidence Test

The second Rule that applies to any such expenditure is that there must be sufficient documentation to support the claim that the expenditure meets the Business Test. We’ll call this the “Evidence Test”. At a minimum, to pass the Evidence Test, an expenditure must be supported by:-

Copy of the receipt, showing date, amount, vendor, and how paid; and

-

Details of the (valid) business purpose of the expenditure.

Food, beverages, entertainment, recreational properties, club dues, and travel

The rules surrounding these items are contained in CRA publications IT-518R and IT-148R3, both of which have been unchanged since 1996. For those who like to read the detail, they can be found at IT-148R3, IT-518R, and IT131R2.

Once it’s clear that the food, beverage or entertainment expenses meet the Business and Evidence Tests, we get into specifics:

-

Unless the expense meets certain exceptions, only 50% of a Test qualified item can be deducted:

-

If you have exceptional Evidence Test documentation, don’t be afraid to be creative in this regard.

-

As an example, there is a 1994 case in which the Tax Court of Canada allowed a small business owner deduct his wedding expenses as they met the Business and the Evidence Tests.

-

-

Exceptions (some good some not so good) to the 50% limitation are as follows:

-

Golf:

-

For some reason CRA doesn’t realize the business value that a game of golf with a customer or a prospect can have. NONE of annual dues, green fees, cart rental costs and initiation fees are deductible;

-

Meals and beverages consumed during or related to a golf outing or at a golf club, are covered in the 50% rule above;

-

-

Club Fees:

-

If your club’s main purpose is to provide dining, recreational or sporting facilities for its members, then dues or initiation fees are also NOT deductible;

-

There are some quirks to this rule that can provide some loopholes:

-

The organization must be a “club”, so things like Ski Resorts may be outside the rule;

-

If <50% of your Club’s facilities are used for dining, recreational or sporting activities, then, as well, they fall outside the non-deductible restriction

Yachts, camps and lodges:

-

Expenses relating to the use or maintenance of a yacht, camp or lodge may not be deducted unless such activities represent a company’s primary business activity;

-

This includes hunting “outfitter’s”, as they are considered lodges by CRA (and the courts);

Functions and meals for the entire staff:

-

This is an interesting one, as the definitions allow for some leeway, to your advantage in the tax treatment of meals, beverages and entertainment:

-

Firstly, any function (such as a Holiday party) is deductible as long as:

-

All staff from any particular office or division of a Company is invited; and

-

No more than 6 such events occur in any given year;

-

If meals are provided to all staff working at a special work-site (ie client’s place of business) and are away from the office for at least 36 hours, all such meals are fully deductible;

-

This can be as small a number of staff as one;

-

Meals provided while away from the business’ office otherwise may still be eligible for the 50% deduction, again based on reasonable Business Test assumptions, such as working through lunch, working beyond normal work hours, treating client to lunch, etc.

Expenses incurred while travelling:

-

Included in travel fare:

-

If meals are included in business-related travel fare (unfortunately quite rare these days), then they are fully deductible, otherwise they are subject to the 50% rule;

Incurred while away from “Home Office” City:

-

As with item 2.4.2. above these are fully deductible.

Conventions:

-

You can deduct the costs of attending up to 2 conventions in any given year.

-

A "Convention" is defined as an event:

A "Convention" is defined as an event: -

held by a business or professional organization,

-

attended in connection with your business, and

-

held at a location that may reasonably be regarded as consistent with the territorial scope of the organization.

-

The rules here are quite specific, but generally, if the organization hosting the convention is "national" in character, the convention can be located in Canada or the USA to qualify;

-

Training courses are not conventions, and costs are deductible subject to the Business and Evidence Tests. The location for the course must be reasonable in the circumstances.

Gifts and awards

One way to generate some deductible expenses without an offsetting taxation in the hands of an employee (remember the owner is an employee as well) is that, up to 2 non-cash gifts can be provided per year, to a a maximum value of $500.00 per gift. That's $1,000 per year per employee that should be taken advantage of.

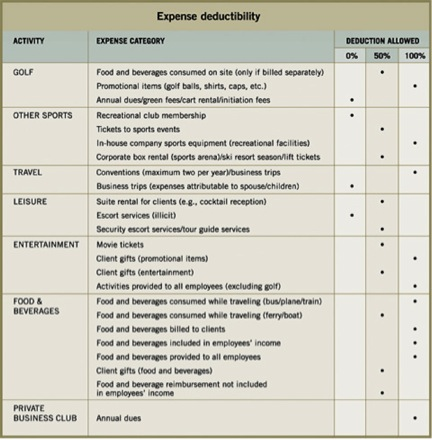

Handy reference chart

Now that I’ve given you an overview, here’s an even handier way to manage these everyday business related tax issues, a Reference Chart, courtesy of Brigitte Alepin MPA, CA:

This overview and reference guide should go a long way in helping guide you as owner of a Canadian small business in how to maximize the tax deductions for areas of business that you are faced with each and every day.

My last 2 points are:

- always remember that, even if legitimate business expenses are resticted from full deductibility by the tax rules, as long as they pass the Business and Evidence Tests, they are still not taxable to the employee that enjoys the benefits of the outlay. This can save anywhere from 24% to 37% in tax outlay, so it pays to ensure these expenditures are handled properly;

- Unfortunately, in cases where such expenses are treated incorrectly by the small business, double taxation is the consequence:

- The amounts are not deductible to the business, and taxable to the person who enjoyed the benefits.

- This should be avoided at all costs.

Next tax planning posting - Motor Vehicle Costs.