Small business owners run the risk of being unpleasantly surprised if the first thing they track in their business is their bank balance. The competition is most definitely tracking other results that give them a decided edge.

Granted cash is still the ultimate business measure, both in terms of short term liquidity and financial success (measured by its growth/decline). However, if it is in decline, it is probably too late to do anything about; it certainly makes it a lot harder to turn around. Also, while sales measurement as well is invaluable, a lot has happened before those sales consummated that the small business owner needs to be aware of.

The Competition has more Business Intelligence than You Do on your Customers

In today's highly competitive and rapidly changing business environment, trends leading to cash flow outcomes need to be recognized much earlier to be able react in time (the word today is "pivot") to maintain sales volumes. Rest assured that your competition is, or already has been identifying these trends and will have an edge over any unsuspecting or skeptical small business owner. These trends can be identified by analyzing data from the business’ activities. As has been possible with the recording, reporting and measurement of financial activities using accounting software for some time now, Cloud computing and new software solutions now extend the recording, reporting and measurement capabilities to pretty much every business activity.

The problem all small businesses face today isn’t lack of information, it’s information overload, and this starts with who to believe, what to use, and why. We’ve dealt with those issues in other Blog articles, such as Results Based Systems for SMB's, or How SMB's Should Use the Cloud. Once that gets sorted out, the questions then become:

- What activities do I gather data from? and then:

- What data do I gather?

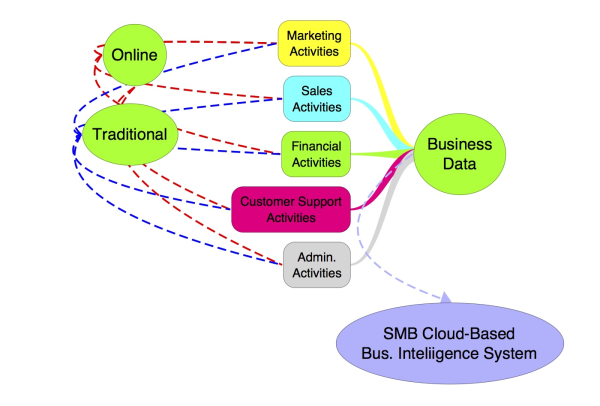

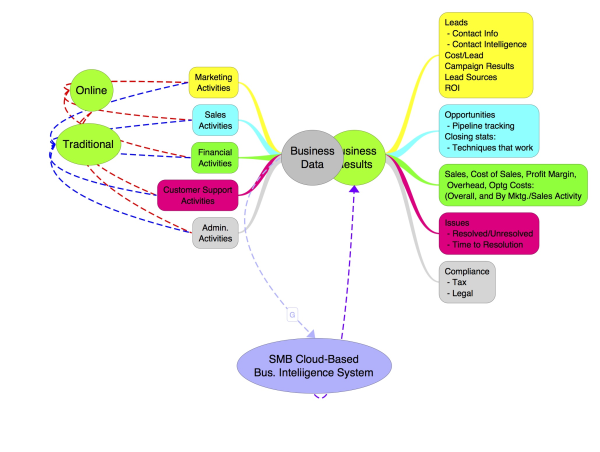

Affordable software solutions exist for the gathering, measuring, and reporting of data from every facet of a small business’ activities, so the answer to which activities to measure is “them all”. Every small business owner should gather data on 5 business activities:

- Marketing;

- Sales;

- Financial;

- Customer Support and Service; and

- Administration

Here’s a graphic that makes this more clear:

- Leads from marketing;

- Sources;

- Conversions;

- Opportunities from sales;

- Sources;

- Conversions;

- Website Visitors and Views;

- Telephone calls received;

- Customer issues:

- Raised;

- Resolved;

- Administrative deadlines:

- Met vs. Not Met.

are now measurable, and become business intelligence that is now as, if not more important than the financial measures. They provide insight into how the small business is progressing and can predict what the financial measures are going to be. This allows for strategic decisions to be made much sooner, and with the right systems, in real-time, avoiding "too little-too late" scenarios, and ensuring that activities and expenditures are being applied to and focused on activities that are working. This not only mitigates competitive threats, but done effectively, increases sales most likely at a lower cost, but for sure with a higher ROI. It’s not often a small business can reduce risk and increase results with one set of strategic decisions.

Our KPI intelligence gathering system is then complete. Each small business is unique, so completing this system for the specific business, and connecting it with the most cost-effective tools and every small business owner has the key data at his/her fingertips to stay competitive and grow their business.

to see how much you need to know about your business, to really understand your numbers.